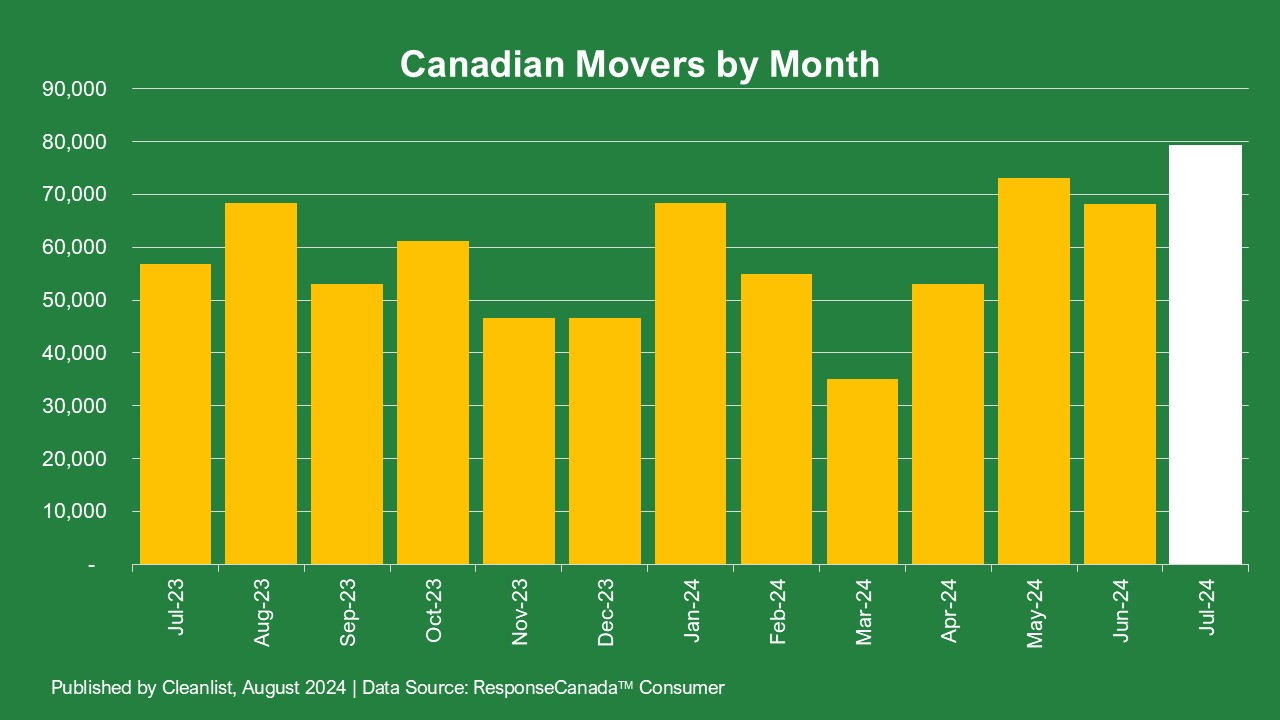

Record-breaking new mover influx in July 2024!

Cleanlist identified 79,173 new movers in Canada this past July. There was a notable 39.1% increase YoY from July 2023 to July 2024 and a slight 16.2% increase MoM from July 2024 to July 2024.

Back in April and May 2024, we saw a massive surge in houses being put on the market, and because of that, we saw a remarkably high new mover count in July 2024. 79,173 is the largest new mover count we have seen in years.

What’s sparked movers to take the leap?

As we know, just because a house is listed on the market does not mean it’s going to sell. Our intent data reveals an interest in moving, but there are obstacles that could get in the way. However, because April and May 2024 pre-mover counts were so high, it’s clear many homeowners were able to sell because of the extremely high number of new movers in July 2024. With the lowered interest rates on buyers’ minds, they were eager to make a move when the time was right.

Could new mover counts get any higher in 2024?

The short answer is yes. The average time to close a house is between 30 and 45 days. With yet another drop in interest rates on July 24, we wouldn’t be surprised to see the new-mover count stay fairly steady in the next couple of months.

Other July 2024 statistics:

- All provinces saw an increase in new movers from June 2024 to July 2024.

- The provinces that saw the biggest increase in new movers YoY were Newfoundland (138.1%), New Brunswick (104.8%), and the Northwest Territories and Nunavut (55.2%).

- All provinces saw an increase in new movers from July 2023 to July 2024.

- The provinces that saw the biggest increase in new movers MoM were the Northwest Territories and Nunavut (87.5%), Nova Scotia (47.4%) and P.E.I. (38.4%).

Why Mover Data Matters

Consumer spending drives sales across many industries and we’ve gathered that spending accelerates significantly for consumers on the move. Some studies report that new movers increase their spending by as much as 10x during the move cycle which lasts between two and six months. Savvy marketers understand this behaviour and put their marketing dollars to work to win more business.

In addition to the obvious packing and moving costs, new movers spend money in three main areas: home improvement, household management, and neighbourhood integration.

Money spent on home improvements typically includes renovations, furniture and appliances, paint, flooring, window coverings, decorating, alarm and security systems, decks, landscaping, roofing and siding, and HVAC systems.

Money spent on household management decisions is less obvious, but also important to new movers. They tend to review and reconsider their spending on things like insurance, financial planning and investments, internet and communication services, energy consumption, and even new vehicles.

And finally, money is spent on neighbourhood integration. New movers tend to change their shopping and entertainment habits while seeking out new stores and services in the neighbourhood for groceries, household supplies, landscaping and snow removal, child care, restaurants and entertainment venues.

Knowing who these new movers are gives marketers a huge competitive advantage by being the first to offer welcome deals, trials, information and other promotions. As we all know, the first to establish a relationship is often the winner of a long-term and profitable customer.