Identify and build lead lists for consumer spending with Cleanlist’s New Movers Data.

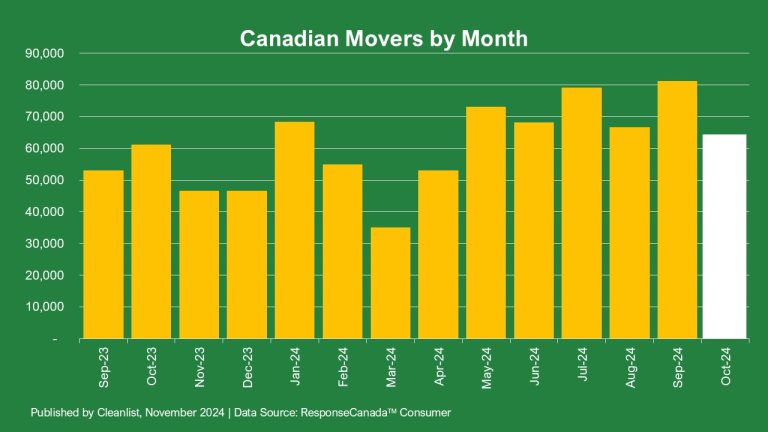

CANADIAN MOVER COUNT FALLS DRASTICALLY FROM SEPTEMBER 2024 to OCTOBER 2024

Cleanlist identified 64,315 new movers in Canada in October 2024. This resulted in a significant 20.9% plummet in new movers from September 2024 to October 2024 and an interesting 5% increase from October 2023 to October 2024.

WHAT CAUSED NEW MOVER COUNTS TO PLUMMET IN OCTOBER 2024?

Despite yet another slash in interest rates by The Bank of Canada on October 23rd, reaching the lowest rate we have seen in 2024 thus far (3.75%), the number of people moving from September 2024 to October 2024 decreased significantly. One explanation could be that October often marks the onset of cooler weather and shorter days, making moving less convenient or appealing. Additionally, families with school-aged children often prefer to settle before the school year begins, leading to fewer moves once fall routines are established. Not to mention, the approaching holiday season may have movers tightening their finances in preparation for the holiday season.

Another point to consider is that there may be a saturation effect, meaning that because so many people moved over the last few months, the demand for homes could be levelling off. Finally, the lower interest rates may influence movers to hold on to their houses in anticipation of lower rates in the near future.

OCTOBER 2024 DATA HIGHLIGHTS:

- Only three provinces saw an increase in new movers from October 2023 to October 2024, including Northwest Territories and Nunavut (21. %), Ontario (19.3%), and Quebec (14.1%).

- The provinces that saw the biggest decrease in new movers from October 2023 to October 2024 were New Brunswick (-22%), Alberta (-20.5%) and Manitoba (-18.3%).

- The only province to see an increase in new movers from September 2024 to October 2024 was Yukon Territory (12%).

- The provinces with the biggest increase in new movers from September 2024 to October 2024 were Newfoundland (-62.1%), New Brunswick (-48.8%) and Nova Scotia (-42.2%).

WHY MOVER DATA MATTERS

Consumer spending drives sales across many industries and data sources gathered that spending accelerates significantly for consumers on the move. Some studies report that new movers increase their spending on a product or service by as much as 10x during the move cycle which lasts between two and six months. Savvy marketers and sales teams understand this behaviour and put their marketing dollars to work to reach new movers and win more business.

In addition to the obvious packing and moving costs, new movers spend money in three main areas: home improvement, household management, and neighbourhood integration.

Money spent on home improvements typically includes renovations, furniture and appliances, paint, flooring, window coverings, decorating, alarm and security systems, decks, landscaping, roofing and siding, and HVAC systems.

Money spent on household management decisions is less obvious, but also important to new movers. They tend to review and reconsider their spending on things like insurance, financial planning and investments, internet and communication services, energy consumption, and even new vehicles.

And finally, money is spent on neighbourhood integration. New movers tend to change their shopping and entertainment habits while seeking out new stores and services in the neighbourhood for groceries, household supplies, landscaping and snow removal, child care, restaurants and entertainment venues.

BUILD LEAD LISTS OF NEW MOVERS FOR COMPETITIVE ADVANTAGE

If the buyer persona of consumers moving to a new home or office sounds like your ideal customer profile, Cleanlist’s New Mover Data can provide high-quality leads based on a list of new movers. This list of ideal prospects with unique pain points for sales reps to address can give marketing teams a competitive advantage.