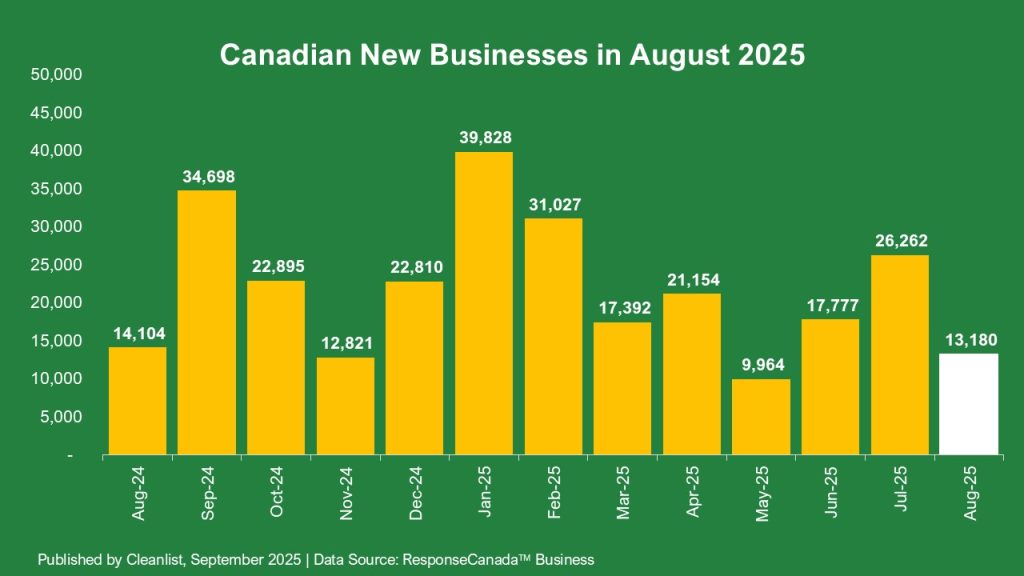

After a strong rebound in July, August saw business formation tumble back to just 13,180 new registrations, down 50% month-over-month and 7% below last August. At the same time, closures spiked to 61,412, a level not seen in over a year, wiping out gains and leaving a net loss of more than 48,000 businesses nationwide.

What’s Driving the Contraction?

Several factors may be at play:

- Seasonality: Summer slowdowns often affect registrations, though August’s drop is far sharper than usual.

- Economic pressures: Higher financing costs and consumer caution may be leading more businesses to shut down.

- Regulatory/administrative timing: Spikes in closures can sometimes reflect reporting cycles or bulk deregistrations.

By the Numbers

- New business starts: 13,180 (↓ 50% MoM, ↓ 7% YoY)

- Business closures: 61,412 (↑ 309% MoM, ↑ 254% YoY)

- Net change: –48,232

This marks one of the steepest single-month contractions in recent history.

💼 Why This Matters

For marketers, lenders, and service providers, these shifts underline the importance of real-time business intelligence. Understanding which businesses are entering or exiting the market is critical for:

- Targeting growth opportunities with new enterprises.

- Protecting portfolios by tracking struggling firms.

- Adapting go-to-market strategies based on regional or sector volatility.

With closures surging, precision targeting matters more than ever — ensuring outreach is directed toward viable, growing firms.

🔍Want to Reach Canada’s Newest Businesses?

Ask about a free data discovery report where we produce a personalized data report, filtered and targeted to just the businesses that matter most to you.