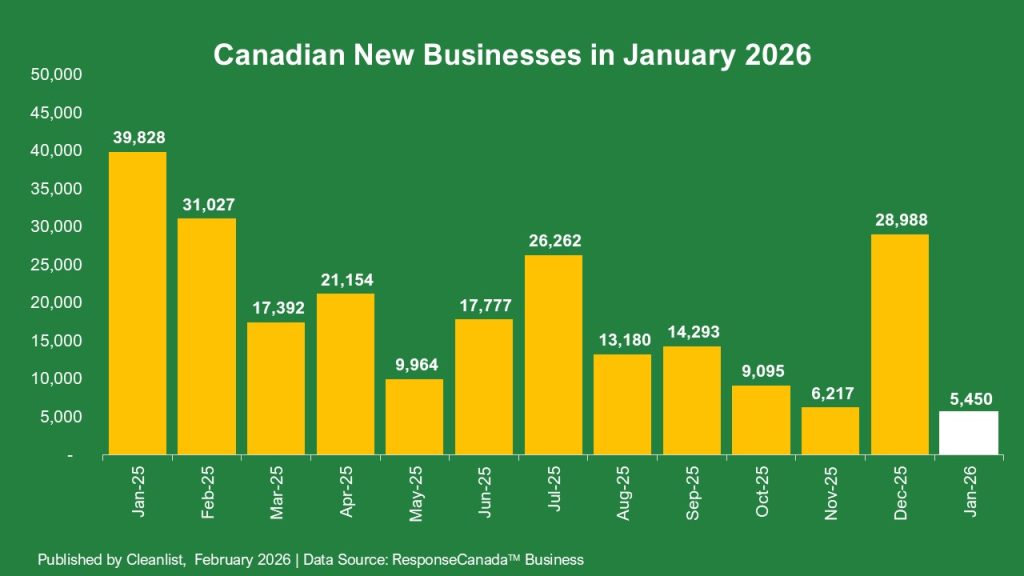

Each month, Cleanlist tracks both newly registered and closed Canadian businesses. Together, these metrics provide a clear view of business churn — and the real operating environment facing Canadian entrepreneurs and the brands that sell to them.

After a surge in year-end formations, January shows a sharp and predictable slowdown.

📊 January 2026 Snapshot

In January 2026, Cleanlist identified:

- 5,450 new businesses

- 8,754 business closures

This results in a net decline of 3,304 businesses nationwide.

Compared to December 2025:

- New businesses ▼ 81% month-over-month (vs. 28,988)

- Closures ▼ 67% month-over-month (vs. 26,618)

- Net growth turned decisively negative after December’s modest gains

This January reset is not unusual — but the depth of the pullback highlights how fragile business formation remains.

Why January Looks So Different from December

December is structurally distorted:

Entrepreneurs rush registrations before year-end

Fiscal and tax timing drives incorporations

Many businesses defer closures until December

January strips those effects away.

What remains is a clearer signal of underlying confidence — and in January 2026, that signal is muted.

Fewer new businesses are launching, and closures continue to outpace formations.

What This Means for Business Churn?

January’s data reinforces a pattern seen throughout 2025:

- Business creation is episodic, not sustained

- Closures remain structurally elevated

- Net expansion is difficult to achieve

In short, Canada remains in a high-churn, low-growth business environment.

Why This Matters for Marketers and Sales Teams

When formations slow, timing matters more than ever.

For organizations selling to businesses:

- New companies are fewer — but highly motivated

- Early vendor decisions happen fast

- Supplier relationships harden quickly after launch

This makes immediate post-formation outreach critical. Waiting even a few months can mean missing the window entirely.

In slower formation periods, precision consistently outperforms volume.

The Cleanlist Takeaway

January’s data confirms that December’s surge was a timing effect, not a turning point.

For teams targeting Canadian businesses in 2026:

- Growth will come from speed and relevance

- Newly formed businesses must be engaged immediately

- Messaging must focus on efficiency, cash preservation, and risk reduction

The opportunity isn’t just knowing how many new businesses are created — it’s knowing who they are and reaching them first.

🔍Want to Reach Canada’s Newest Businesses?

Cleanlist offers free self-service counts to help you size the opportunity. See our business data page for more information and links.