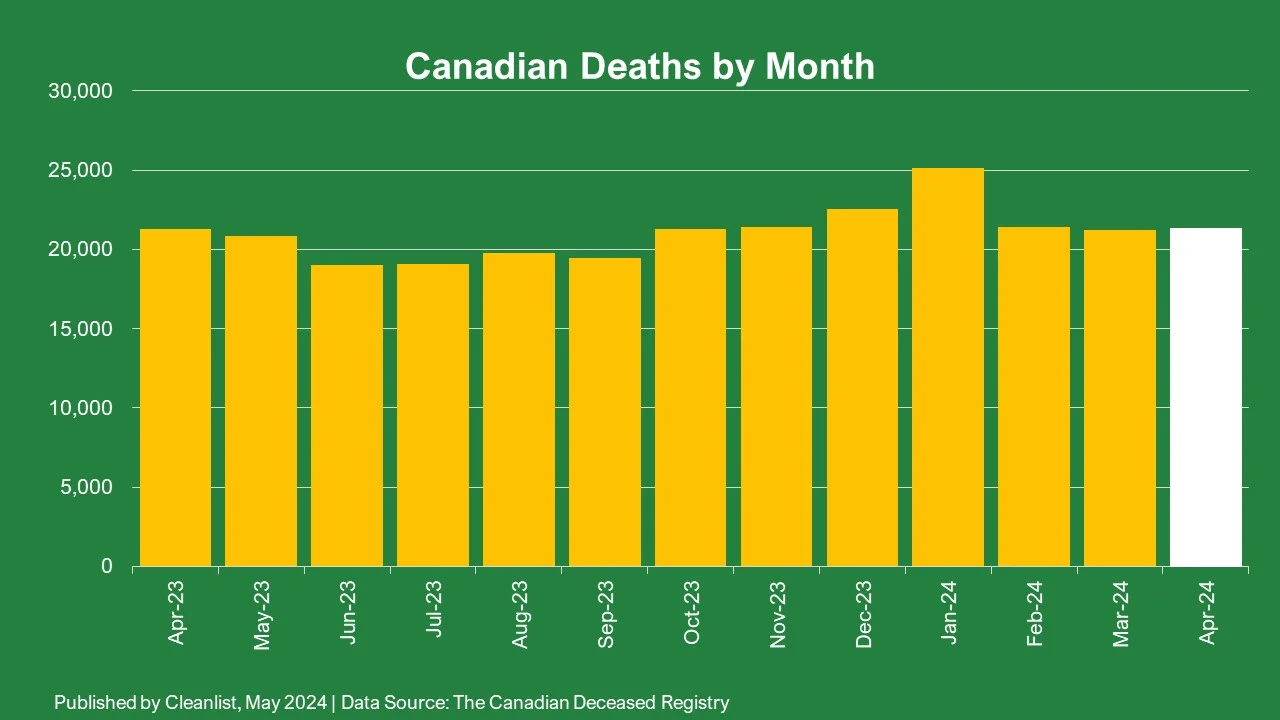

Steadfast death rates cruising into May

Cleanlist reports that 21,323 Canadians passed away in April 2024. There was a small 0.4% increase in deaths month-over-month from March 2024 to April 2024 and an ever-so-slight 0.1% increase from April 2023 to April 2024. Additionally, the average age of death in April 2024 remains at 78 years old, continuing to stay on par with each month thus far in 2024. This data is summarized from the Canadian Deceased Registry.

Notable stats from April 2024:

- The provinces that saw the biggest increase in deaths from April 2023 to April 2024 were P.E.I. (10.9%), Newfoundland (9.6%) and Nova Scotia (6.8%).

- The only provinces to see a decrease in deaths from April 2023 to April 2024 were Ontario (4.4%), Saskatchewan (2%) and British Columbia (0.3%).

- The provinces that saw the biggest increase in deaths from March 2024 to April 2024 were New Brunswick (12%), P.E.I. (11.7%) and Newfoundland (6.4%).

- The only provinces to see a decrease in deaths from March 2024 to April 2024 were Ontario (1.7%) and Saskatchewan (0.4%).

What factors might be contributing to steadying death rates in the last few months?

Given that this winter was fairly mild compared to your average Canadian winter, death rates continued to slow and steady as early as February this year. When cold weather lingers, it often contributes to the spread of illnesses, therefore increasing death rates. However, since this year we were graced with warmer winter temperatures and more opportunities to gather outdoors, the spread of illnesses plateaued earlier than in previous years.

How Is Canadian Deceased Data Used?

There are many ways organizations can effectively utilize mortality data. Here are the top 3.

#1 – Fraud Protection

In 2022, the Royal Canadian Military Police (RCMP) reported that there were 19,560 counts of identity theft in Canada amounting to $146 million in losses. Fraudsters will often exploit deceased individuals’ information to create false identities and engage in illicit transactions. They are expecting fraud activities to increase in 2023 and 2024.

Credit issuers can protect themselves by cross-referencing new applicant information against the Canadian Deceased Registry.

#2 – Policy Over-Payments

Pension funds and some annuity insurance policies make benefit payments to their policyholders to the date of death. When the death is not reported, or when the reporting is delayed, significant over-payments occur.

Payors can reduce over-payments and improve administrative efficiency by regularly scanning their payee population against the Canadian Deceased Registry.

#3 – Marketing & Reputation Management Mishaps

Organizations involved in marketing communications, fundraising, and customer relations can find themselves in an awkward and unpleasant situation by attempting to solicit deceased family members. This damages valuable brand reputations.

Marketing and CRM managers can avoid these situations by scrubbing their campaign lists against the Canadian Deceased Registry.

About the Data

The data presented in this report was summarized by Cleanlist from the Canadian Deceased Registry, Canada’s only national registry of deceased Canadians. To learn more about the database or for licensing information:

Cleanlist is Canada’s largest customer data company. We clean, enrich, and validate business and consumer data. We’re also experts in data-driven document composition and Canada’s largest data provider for digital and offline marketing. To learn more, visit us at Cleanlist.ca.